Old Company Name ECOVIS AHL TAX SERVICES SDN. Payment of sales tax shall be made by Toyo Plastic Sdn Bhd as the sales was made on credit to Eco Enterprise on 15 May 2019.

Qatar Currency Timeline Exchange Rate All About Qatari Riyal Qatar Currency Qatari

On the First 50000 Next 20000.

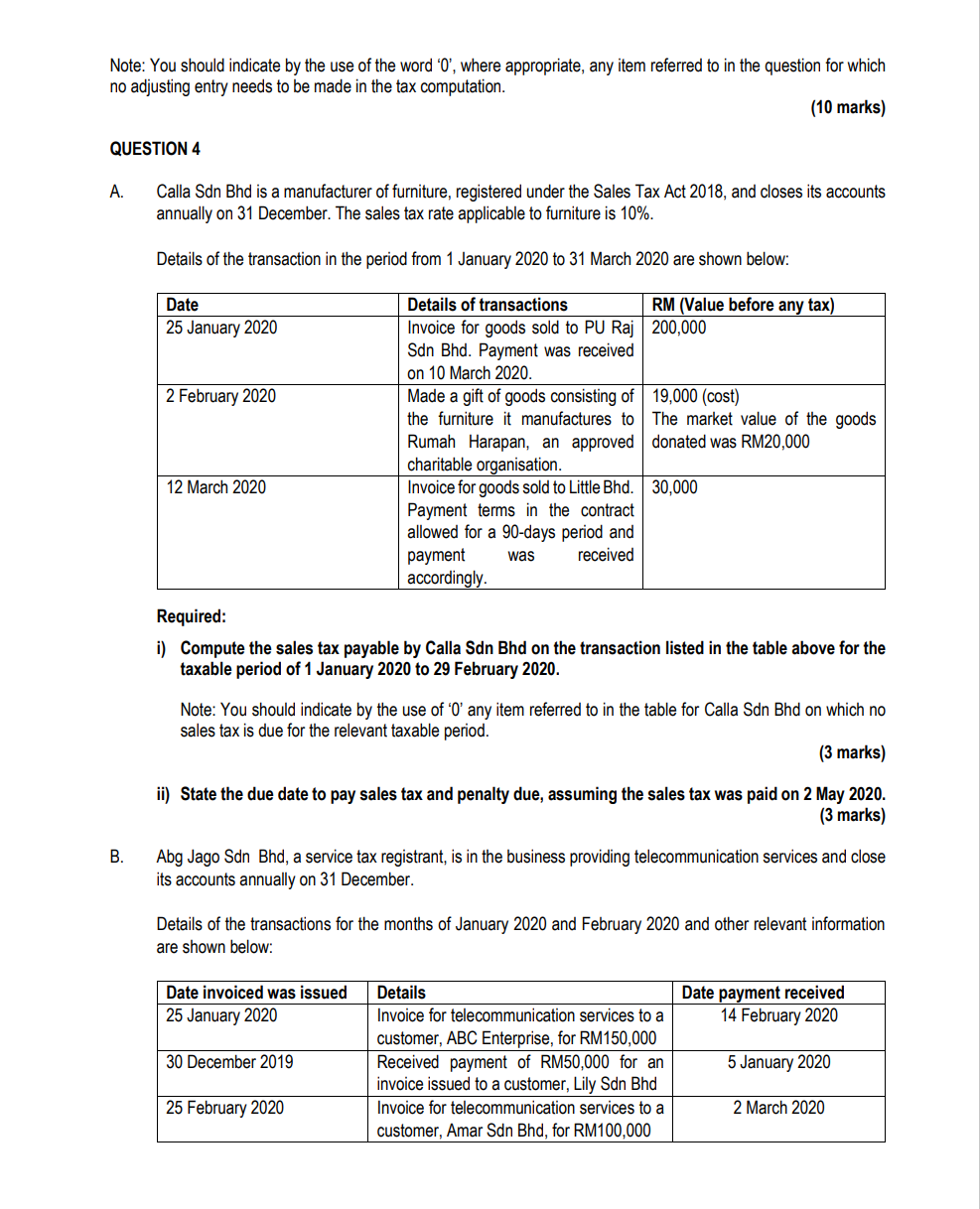

. The average interest rate for a 30-year fixed-rate mortgage for 2019 was 394. The sales tax rate is 10. B Installation and commissioning services.

A Sdn Bhd bought a power plant from B Ltd a company resident in India. On the First 5000 Next 5000. All retained earnings available as at 30 June 2019 is going to be used for re-investment purposes.

Malaysias 2019 Budget will see an increase in stamp duties to 4 from 3 for transfer of real properties that are RM1 million and higher. On the First 2500. On the First 20000 Next 15000.

First RM500000 profit 20 Above RM500000 profit 25 Maximum tax rate for individual is 26. Are effective 1 January 2019. For resident individuals and Malaysian citizens the RPGT rate is increased from 0 to 5 for disposals in the 6.

Tax under section 109B of the ITA at the rate of 10. Glocomp Systems M Sdn Bhd v KPHDN High Court 5. The fees paid to B Ltd for the services was RM100000.

The rate of 0 has been in place for many years. On first RM500000 17 Subsequent Balance 24 c Resident individuals. Gift and Estate Tax Rates 2020 to 2022 Value of Taxable Estate or Gift Marginal Tax Rates 2020 2021 2022 Up to 5100000 None None None.

Company information for ECOVIS MALAYSIA TAX SDN BHD with registration number 199501031895 361101-M incorporated in Malaysia. The average rate for 2021 was 296 the. The additional tax would be RM 840 where their income is taxed at the top rate of 28 percent.

Currently the corporate tax rate for companies have less than 25 million share capital are as follows. On the First 10000 Next 10000. Effective date Year of Assessment YA 2020 and subsequent YAs.

Toyo Plastic Sdn Bhd has to remit the sales tax of RM2. To MYR 3000 starting in 2019. The further increase of 5 is to be.

However if you qualify as a small medium enterprise SME the first RM600000 of chargeable income will subjected to a lower rate of 17 with the remaining balance taxed at the rate of 24. Toyo Plastic Sdn Bhd has to. Company Name ECOVIS MALAYSIA TAX SDN.

On the First 35000 Next 15000. The company tax system of Malaysia is considered a major contributor to the economic development of the country. Income tax rates a Companies 24 b Small companies Chargeable income.

Chargeable income MYR CIT rate for year of assessment 20212022. Date of Change 2019-03-20. Type of Company LIMITED BY.

Company with paid up capital not more than RM25 million. Tax Rate of Company. Because sdn bhd company is taxed separately from their owners and the corporate tax rate is generally lower than the individual tax rate.

For non-resident individuals the applicable tax rate is increased by 2 to be in line with the changes which is 30. Describe the applicable tax treatment on the taxable goods sold to Eco Enterprise on 15 May 2019. Tax rates of corporate tax as of Year of Assessment 2021 Paid-up capital of RM25 million or less.

KPHDN v Kompleks Tanjong Malim Sdn Bhd High Court 4. Corporate - Taxes on corporate income. Income Tax Rules 2019 in relation to deduction on issuance of Retail Debenture Retail Sukuk and Sukuk Upcoming events.

For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia. Foundingbird Sdn Bhd 201901035214 1344544-U 7-2 Plaza Danau 2 Jalan 2109f Taman Danau Desa 58100 Kuala Lumpur Malaysia. 2019 Deloitte Tax Services Sdn Bhd Deloitte TaxMax The 45thseries 4 Introduction of new marginal tax rates for the highest income bands.

It is proposed that the tax or additional tax payable be increased by a flat rate of 10 for an Amended Return furnished within 6 months from the statutory submission deadline. On the first RM 600000 chargeable income. New common stocks ii.

The corporate tax rate is 24. Opportunities and Risks of Digitalisation in the Fourth Industrial Revolution Important. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba.

Calculate the individual after-tax cost of. Rate TaxRM 0 - 2500. The following tax rates are to be used in answering the questions.

Supervise the installation and operation of the plant from 1542019 to 3152019. Calculate the number of bonds to be issued if the company plans to undertake the above projects. The current CIT rates are provided in the following table.

Headquarters of Inland Revenue Board Of Malaysia. A Company in Malaysia is subject to income tax at the rate of 24 based on law stated as at 2019. Last reviewed - 13 June 2022.

Corporate tax Malaysia is charged to the resident company or Sdn Bhd receiving income within Malaysia and outside Malaysia for a firm holding insurance air transportation sea and banking related businesses. Tax Relief on Net Savings in the National Education Savings Scheme SSPN To further encourage parents to save for financing the tertiary education of their children it is proposed that resident. The rates will be lowered in 2022 2023.

There will be a two-year stamp duty exemption for the first RM300000 for houses priced up to RM500000. You can calculate your taxes based on the formula above and just make sure your total income in the first column comes up to. First-time homebuyers will have stamp duty exemption for homes between RM300000 to.

The RPGT rate for companies non-residents and non-Malaysian citizens will be increased from 5 to 10 for disposals in the 6.

Company Tax Rates 2022 Atotaxrates Info

Pin On Aluminium News Price Updates

Kopiko Sdn Bhd Income Statement For The Year Ended 31 Chegg Com

Malaysia Personal Income Tax Guide 2021 Ya 2020

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Sugar Import In Malaysia Process Of Applying For This License Malaysia Sugar Tax How To Apply

Jarifaly123 I Will Design Receipt Book Shop Paper Cash Memo And Docket Book For 5 On Fiverr Com Invoice Design Invoice Design Template Memo Format

1 Nov 2018 Budgeting Inheritance Tax Finance

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

The State Of The Nation Finding Room To Lighten The Middle Income Tax Burden The Edge Markets

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Public Revenue To Shrink To Rm227 3b In 2020 Amid Lower Tax Collection The Edge Markets

Everything You Need To Know About Running Payroll In Malaysia

The State Of The Nation Finding Room To Lighten The Middle Income Tax Burden The Edge Markets

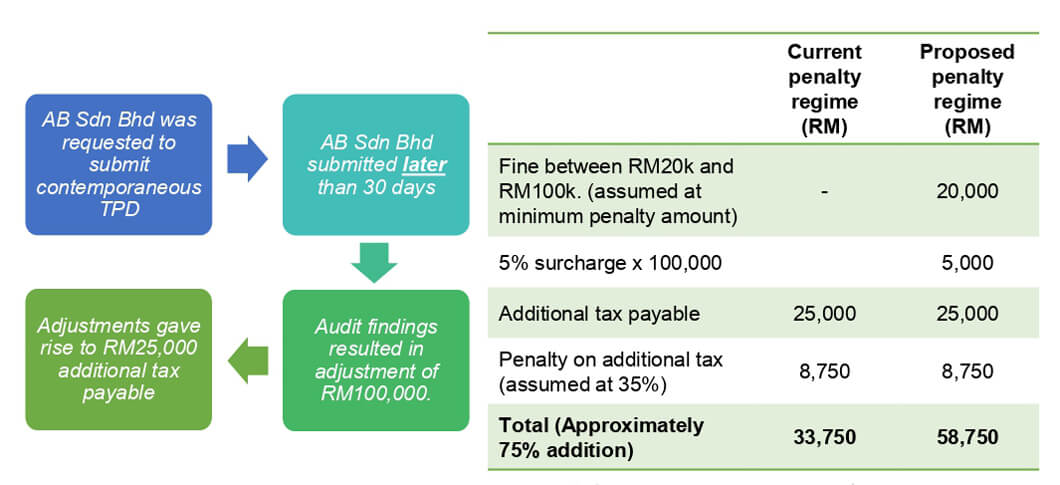

Transfer Pricing Requirements And New Penalties In Malaysia Shinewing Ty Teoh

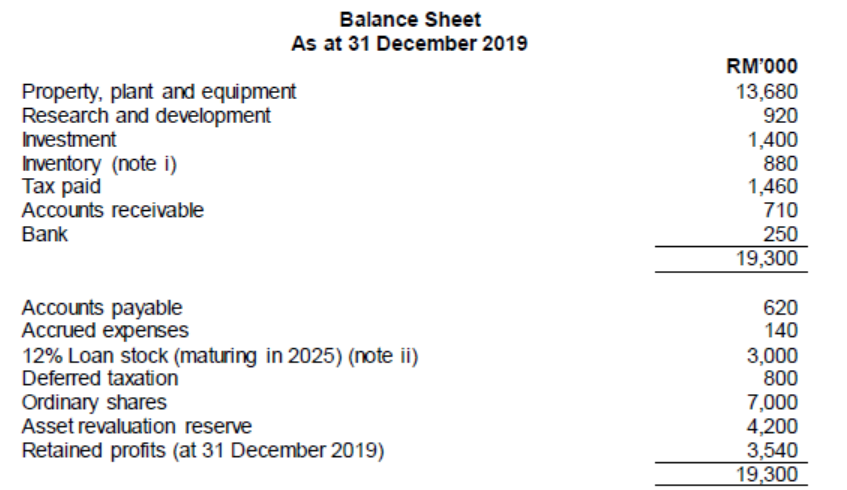

Section B All Six Questions Are Compulsory And Must Chegg Com

Income Tax Malaysia 2018 Mypf My